#STUC16 The STUC has backed a UNISON and GMB 10 point plan for decent public services which are key to ‘reducing poverty and economic inequality.’

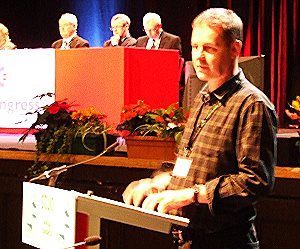

UNISON’s Stephen Smellie told delegates there was a broad political consensus in Scotland against austerity but words were not enough.

“We must insist that Scottish politicians can’t hide behind the ‘it’s all the fault of the Tories and we can’t do anything about it’ line. That was never good enough when the Scottish parliament had few powers to tackle austerity. It is even less acceptable now that the parliament has significant powers that it can choose to use.

“UNISON’s publication ‘Combating Austerity’ spells out the steps that Councils and the Government can take. I commend it to every candidate for parliament and every councillor.”

Stephen slammed the 40,000 jobs cut from local government and called for no compulsory redundancies in local government.

“We need to see politicians devising plans as to how they will use existing and future taxation powers of the Scottish Parliament to oppose austerity and create prosperity”, he said.

“And in that light it is very welcome that Labour has drawn the conclusion that we drew years ago – we need to increase taxes, especially on the rich, to fund the level of services that the people of Scotland want.

“We need politicians to be creative, be bold and who will work with us to oppose austerity.”

The motion called on politicians to oppose the cuts rather than ‘passively administering them’. It called strategies to invest in services and get out of costly PFI schemes. It wants a fairer local property tax, a review of charges for services and the better use of pension funds by investing in projects like affordable housing.

It also called on the Scottish government to use new tax powers to invest in public services. Staff skills should be recognised with decent pay and conditions along with union/employer partnerships.

Stephen told delegates: “The Edinburgh schools fiasco has highlighted the disgrace of PFI – these deals need to be changed through the use of prudential borrowing and bonds so that we don’t continue to pay through the nose for decades to come.

“Local taxation needs to be reformed so that councils have a sustainable financial base. That includes different forms of tax raising powers and a fair local property tax.

“We have argued for an end to the Council Tax freeze from before it was implemented and so it is good to see the government finally say that it will end– but not till next year and only so they can direct councils how to spend the revenue raised. It is a start but not good enough.”